top of page

Search

What is a POD/TOD Account? (And How a Simple Mistake Can Cost You Thousands)

In the world of estate planning, especially in Florida, tools like POD and TOD accounts are designed to make passing on assets simple and efficient. But as more families deal with investment accounts and financial institution changes, a small oversight can lead to unexpected Probate costs—potentially thousands of dollars and months of delays. If you're wondering, "What is a POD/TOD account?" or how to avoid common pitfalls, this guide breaks it down step by step based on rea

atCause Law Office

8 hours ago4 min read

How to Keep Your Florida Second Home Out of Probate

As a affluent resident of Florida, owning multiple properties like luxury condos can be a hallmark of financial success. But when it comes to estate planning, ensuring your second home avoids the lengthy and costly probate process is crucial. Probate in Florida can tie up assets for months or even years, potentially exposing them to creditors, taxes, and family disputes. If you're a married couple with one condo in joint names and another solely in one spouse's name, you're

atCause Law Office

3 days ago5 min read

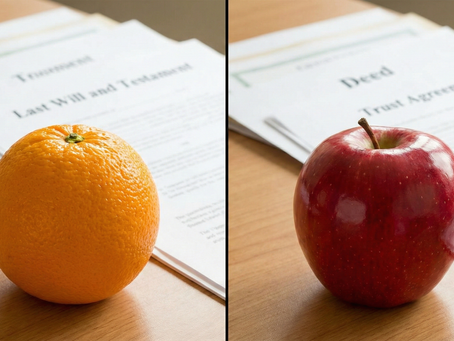

The Hidden Costs of Cheap Deed Preparation in Florida: Hiring an Experienced Attorney

In Florida's complex world of deeds, trusts, and estate planning , the temptation to cut costs on deed preparation can be strong. However, doing it yourself or using unqualified cheap alternatives often leads to unintended consequences like multiple probates and title complications. Hiring an experienced attorney ensures your deed aligns with your goals, avoiding costly pitfalls. Let's break down why, using a real-life story to illustrate the difference. The Risks of Inadequa

atCause Law Office

4 days ago3 min read

Assets That Still Go Through Probate in Florida (Even With a Will)

Most Florida families assume a simple last will and testament is enough to pass their assets smoothly to loved ones. It’s not. Even with a properly executed will, many of your most valuable assets still must go through probate – the formal court-supervised process. According to the Florida Office of the State Courts Administrator, there were 67,808 probate filings in FY 2024-25 (part of 141,166 total circuit probate-related cases). That means thousands of Florida families e

atCause Law Office

6 days ago2 min read

The Hidden Costs of DIY Legal Documents: Why Online Forms Are the "Fast Food" of Law

Quick Answer: Are online legal documents safe to use? While platforms like LegalZoom and LegalShield offer discounted, hands-off templates for LLCs and wills, they carry significant hidden risks. Because these platforms have strict "no liability" clauses and do not provide actual legal advice, mistakes are common [1]. Fixing these errors often costs significantly more in litigation or probate fees—sometimes draining up to 10% of an estate's value [2]—than hiring an attorn

atCause Law Office

Feb 274 min read

The Cost of Cheap Estate Planning: Why the Language in Your Documents Matters

Many people try to save money by taking estate planning into their own hands. It is tempting to write up a quick will or simply add a child’s name to a deed or bank account to avoid the probate process. However, the exact language in these cheap or DIY plans often creates massive legal conflicts, meaning your true wishes might never actually be enforced. As we enter what financial experts call "The Great Wealth Transfer," the stakes have never been higher. Over the next 20 ye

atCause Law Office

Feb 234 min read

Can Medicaid Take Your Home? Transfer on Death vs. Lady Bird Deeds

One of the most common fears for homeowners is losing their house to pay for long-term care. A frequent question we receive is: "I filed a Transfer on Death on my home, bank account, and car titles. Can Medicaid still go after my home if I enter a nursing home?" The short answer is: It depends entirely on the state you live in. If you are trying to protect your assets from Medicaid recovery, understanding the specific tools available in your state—like Florida's "Lady Bird De

atCause Law Office

Feb 173 min read

Why a Deed is Your Home's Best Defense Against Probate

Is your most prized asset protected from the court system? Discover how a specific type of deed can secure your real estate’s future without the headache of probate. When thinking about the future, most people worry about who gets what. However, the how is just as important. For many homeowners—especially here in Florida—the "how" often involves a lengthy, expensive court process known as probate . But there is a solution. It’s not always a complicated trust; often, it is a

atCause Law Office

Feb 123 min read

The "Silent Deed" Mistake: How Saving Money Caused a Double Probate Nightmare

Is it worth paying extra money to have an attorney prepare your deed, or can you save a few dollars by doing it yourself or using a less qualified preparer? Many people assume a deed is just a piece of paper with names on it. However, a recent case in our office highlights exactly why "saving money" on a deed can end up costing your family thousands of dollars and years of stress later. Here is a real-life story of how one missing phrase caused a "double probate " nightmare.

atCause Law Office

Jan 273 min read

The Florida Probate Trap: Why Your "Transfer on Death" Account Might Fail

Are TOD and POD accounts guaranteed to avoid Florida probate? No, not anymore. While Transfer on Death (TOD) and Payable on Death (POD) accounts are specifically designed to bypass probate by passing assets directly to beneficiaries, we are seeing a rapidly increasing frequency in Florida where these accounts fail. This failure forces the estate into the court process, costing heirs time and legal fees. The primary cause is not a flaw in the law, but an administrative failur

atCause Law Office

Jan 263 min read

Inheriting a Home in a Revocable Trust with a Mortgage: Do You Have to Refinance?

Inheriting a home from a parent is a significant life event, but it often comes with complex questions—especially if the property is in a revocable trust and has an existing mortgage. If you are a beneficiary ready to make the home your primary residence, you might be asking: Can I just keep paying the mortgage? Do I have to refinance? This guide breaks down exactly how the situation works under Florida law and federal statutes based on expert insights. 1. How the Transfer of

atCause Law Office

Jan 203 min read

Beneficiary vs. Will: Which One Wins? (Why Your Estate Plan Might Fail)

When planning your estate, most people assume their Last Will and Testament is the ultimate authority on who inherits their assets. You might believe that if you write in your Will that your assets should be split evenly among your children, that is exactly what will happen. However, there is a specific legal designation that outweighs your Will. If you do not understand the hierarchy of estate planning assets, your written instructions could end up being useless. Does a Wil

atCause Law Office

Jan 123 min read

Inheriting a Florida Home in a Revocable Trust: Do You Keep the Homestead Exemption?

One of the most common questions Florida estate planning attorneys receive involves the transfer of family property. Specifically, when a parent (the grantor) passes away and leaves their home to a child through a revocable trust, what happens to the property taxes? Does the child get to keep the parent's original homestead exemption rate? If not, how does the beneficiary handle the new tax situation? This guide breaks down exactly how the Florida homestead exemption works w

atCause Law Office

Jan 83 min read

Estate Planning Costs: Why Cheap Online Deeds Often Fail

If you are asking "What should be the price of an estate plan that includes two deeds?" , the answer depends heavily on the level of service and where you live. Online/DIY Forms: $50 – $150 (High risk of errors) Attorney-Drafted Deeds: $350 – $950 per deed (Plus recording fees) Basic Trust Plan (Low End): $2,500 – $3,000 Comprehensive Trust Plan (Couples/High Service): $5,000 – $7,000+ Note: Prices vary by state and county. The ranges above reflect typical costs for servi

atCause Law Office

Jan 63 min read

Deed Beats Will: Your Florida Home Plan Is Probably Broken

You’ve worked your entire life for your home. You don’t want your kids fighting in probate court. So you think: “I’ll just put the deed in my favorite child’s name now and write in my will that when they sell it, they have to split the proceeds with their siblings.” Stop right there. That plan will almost certainly fail – and your family could lose everything you intended for them. Here’s the harsh truth most people discover too late: A deed beats a will – every single time.

Ashly Guernaccini

Dec 8, 20253 min read

Why Adding Someone to Your Business to Avoid Probate Can Backfire: A Real Estate Planning Story

During an estate planning consultation I ran into a situation I’ve seen many times over the years—one that I suspect happens far more often than people realize. Because so many families face the same dilemma, I wanted to break it down in a way that can help others who are weighing similar choices in their estate planning. Meet “Bob” and His Two Estate Planning Goals For privacy reasons, we’ll call today’s client “Bob.” Bob came in with two very common goals: Keep costs as low

Ashly Guernaccini

Dec 2, 20254 min read

Living Trust vs. Beneficiary Designations: Why Just Using POD or Beneficiary Forms Can Be a Huge (and Expensive) Mistake

One of the questions we're asked almost every week by new clients is: “Do I really need a living trust, or is it fine to just put my kids (or whoever) as beneficiaries/POD on my bank and retirement accounts?” It sounds like a simple shortcut. After all, both methods avoid probate. But in practice, relying only on beneficiary designations (also called TOD for stocks or POD for bank accounts) is one of the most common and costly estate-planning mistakes I see. Here’s the plain-

Ashly Guernaccini

Nov 28, 20254 min read

The Trump Card in Estate Planning: Why Your Beneficiary Designations Always Beat Your Will

Have you ever played a card game where you thought you had the winning hand… until someone slams down a trump card and takes the entire pot? That’s exactly what happens in estate planning more often than you realize — and most people never see it coming. In estate planning , a “trump card” is any designation on an asset that automatically overrides everything else you’ve written in your will or trust. No matter how carefully you drafted your will, no matter how many hours yo

atCause Law Office

Nov 21, 20253 min read

Florida: Only One Spouse on the Deed But Both on the Mortgage – What Happens When Someone Dies? (2025 Guide)

Only One Spouse on the Deed But Both on the Mortgage in Florida – Here’s What Actually Happens I get this question every single week: “We bought the house before we got married. Both of us are on the mortgage, but only one name is on the deed. If something happens to my spouse, do I automatically get the house?” The short answer: No — you do NOT automatically get the house. In Florida, ownership is decided 100% by the deed. The mortgage means nothing when it comes to who leg

atCause Law Office

Nov 20, 20252 min read

Can Someone Remove You from a Property Deed Without Your Permission in Florida?

If you co-own a home or land in Florida and you’re worried about whether the other person can secretly create a new deed that takes you off the title without your knowledge or consent , you’re not alone. This is one of the most common estate questions Florida property owners ask. Short answer: It depends entirely on how you and the other person hold title on the deed. In many cases — especially if the deed is silent or says “tenants in common” — the other owner can transfe

atCause Law Office

Nov 18, 20253 min read

Blog

bottom of page

.png)