top of page

Search

The "Silent Deed" Mistake: How Saving Money Caused a Double Probate Nightmare

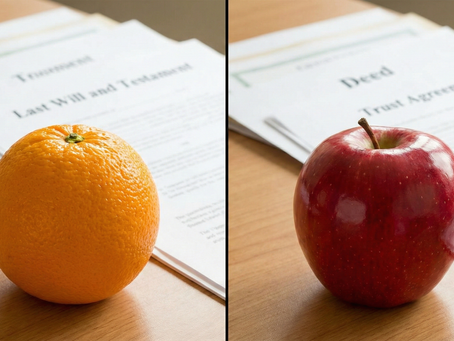

Is it worth paying extra money to have an attorney prepare your deed, or can you save a few dollars by doing it yourself or using a less qualified preparer? Many people assume a deed is just a piece of paper with names on it. However, a recent case in our office highlights exactly why "saving money" on a deed can end up costing your family thousands of dollars and years of stress later. Here is a real-life story of how one missing phrase caused a "double probate " nightmare.

atCause Law Office

11 hours ago3 min read

Estate Planning Costs: Why Cheap Online Deeds Often Fail

If you are asking "What should be the price of an estate plan that includes two deeds?" , the answer depends heavily on the level of service and where you live. Online/DIY Forms: $50 – $150 (High risk of errors) Attorney-Drafted Deeds: $350 – $950 per deed (Plus recording fees) Basic Trust Plan (Low End): $2,500 – $3,000 Comprehensive Trust Plan (Couples/High Service): $5,000 – $7,000+ Note: Prices vary by state and county. The ranges above reflect typical costs for servi

atCause Law Office

Jan 63 min read

The Hidden "Transfer on Death" (TOD) Trap: Why Your Investment Accounts Might Still End Up in Probate

Quick Summary: Many Florida residents assume listing a "Transfer on Death" (TOD) or "Payable on Death" (POD) beneficiary protects their accounts from probate. However, if your financial institution merges or transfers your account to a new company, the original beneficiary paperwork can get lost. Without written confirmation from the new institution, your heirs may be forced into probate even if your monthly statements list them as beneficiaries. We are noticing an alarming

atCause Law Office

Dec 18, 20254 min read

Living Trust vs. Beneficiary Designations: Why Just Using POD or Beneficiary Forms Can Be a Huge (and Expensive) Mistake

One of the questions we're asked almost every week by new clients is: “Do I really need a living trust, or is it fine to just put my kids (or whoever) as beneficiaries/POD on my bank and retirement accounts?” It sounds like a simple shortcut. After all, both methods avoid probate. But in practice, relying only on beneficiary designations (also called TOD for stocks or POD for bank accounts) is one of the most common and costly estate-planning mistakes I see. Here’s the plain-

Ashly Guernaccini

Nov 28, 20254 min read

Can Medicaid Take Your House After a Parent's Death? Insights on Joint Tenancy with Survivorship in Florida

If you're a joint tenant with rights of survivorship on a property with your parent, and they're receiving government benefits like SSDI or Medicaid, you might worry about what happens to the house after they pass away. A common question is: Can the government come after the house? In this post, we'll break down the key differences between SSI and SSDI, explain why Social Security typically isn't a concern for property liens, and dive into how Medicaid recovery works—especial

atCause Law Office

Oct 21, 20253 min read

Do You Need a Lady Bird Deed if You Already Have a Trust?

When it comes to estate planning, one common question is whether you still need a Lady Bird deed if you already have a trust in place. The answer depends on your goals, the type of assets you own, and where you live.

atCause Law Office

Aug 25, 20253 min read

Does a Deed override a Will in Property Transfers? Understanding Probate and Estate Planning

When planning your estate, you may question what happens if you deed property to Person A before death, but your will instructs Person A to split sale proceeds with Persons B and C.

atCause Law Office

Jul 22, 20254 min read

Blog

bottom of page

.png)