top of page

Search

Assets That Still Go Through Probate in Florida (Even With a Will)

Most Florida families assume a simple last will and testament is enough to pass their assets smoothly to loved ones. It’s not. Even with a properly executed will, many of your most valuable assets still must go through probate – the formal court-supervised process. According to the Florida Office of the State Courts Administrator, there were 67,808 probate filings in FY 2024-25 (part of 141,166 total circuit probate-related cases). That means thousands of Florida families e

atCause Law Office

6 days ago2 min read

Why You Need a Detailed Durable Power of Attorney (And Why "Simple" Is Often Dangerous)

A Durable Power of Attorney (DPOA) is widely considered one of the most essential documents in an estate plan. However, a significant issue frequently arises when individuals rely on short, generic forms found on the internet or drafted by those without specific experience in Elder Law . While the desire for a simple, one-page document is understandable, "less isn't always better." In fact, when it comes to legal authority, lack of specificity can lead to disastrous conseque

atCause Law Office

Feb 133 min read

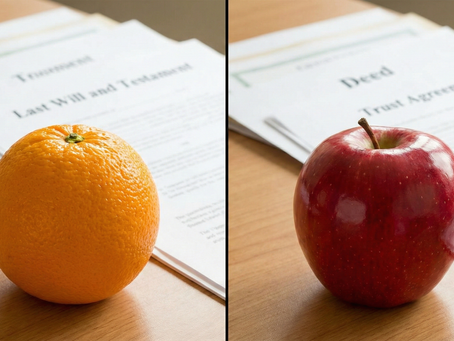

Warranty Deed vs. Will: Which Controls Inheritance in Florida?

Quick Summary: Many property owners assume a standard deed protects their heirs. However, unlike a Lady Bird deed, a Warranty Deed is designed to protect a buyer's title, not to manage inheritance. If you only have a warranty deed, your property will likely go through probate, and your Last Will and Testament will determine who gets it—not the deed itself. The Common Confusion: "I Have a Deed, Do I Need a Will?" A frequent question we receive at atCause Law Office involve

atCause Law Office

Jan 224 min read

Inheriting a Home in a Revocable Trust with a Mortgage: Do You Have to Refinance?

Inheriting a home from a parent is a significant life event, but it often comes with complex questions—especially if the property is in a revocable trust and has an existing mortgage. If you are a beneficiary ready to make the home your primary residence, you might be asking: Can I just keep paying the mortgage? Do I have to refinance? This guide breaks down exactly how the situation works under Florida law and federal statutes based on expert insights. 1. How the Transfer of

atCause Law Office

Jan 203 min read

Estate Planning Costs: Why Cheap Online Deeds Often Fail

If you are asking "What should be the price of an estate plan that includes two deeds?" , the answer depends heavily on the level of service and where you live. Online/DIY Forms: $50 – $150 (High risk of errors) Attorney-Drafted Deeds: $350 – $950 per deed (Plus recording fees) Basic Trust Plan (Low End): $2,500 – $3,000 Comprehensive Trust Plan (Couples/High Service): $5,000 – $7,000+ Note: Prices vary by state and county. The ranges above reflect typical costs for servi

atCause Law Office

Jan 63 min read

Can Someone Put You on a Deed Without Your Consent in Florida?

Short Answer: Yes. In Florida, a property owner can sign a deed and add you as a co-owner or beneficiary without your knowledge or signature. However, for the transfer to be legally binding, you must "accept" it. If you have recently discovered you were placed on a deed without your permission, or you are worried about unwanted property liability, this guide explains how Florida law handles these transfers and what steps you must take to protect yourself. How Is It Possible

atCause Law Office

Jan 23 min read

Do You Really Need an Attorney to Prepare Your Deed in Florida? A Real-Life Cautionary Tale

Many people wonder if it's worth paying an attorney to prepare a property deed, or if they can save money by doing it themselves or using a less qualified helper. A real example from a recent office consultation shows why that decision matters. What Happened When a Deed Was Prepared Incorrectly A father owned his property outright. He entered a long-term relationship with a woman and decided to add her to the deed. The new deed simply listed both of their names as grantees, w

atCause Law Office

Dec 15, 20253 min read

2025 Florida Medicaid Income & Asset Limits Update: What Changed and How to Still Qualify (Even Last-Minute)

As of January 2025, the Medicaid gross monthly income limit increased from $2,829 (2024) to $2,991 . Yes – it went from $2,829 to $2,991. It’s a small increase (typical every year to account for inflation), but it’s an increase, and that extra $162 per month now lets some people qualify automatically who were previously $50–$100 over the old limit. The 2025 Medicaid Numbers You Need to Know Gross Monthly Income Limit: $2,991 Asset Limit: $2,000 (unchanged) – you must be able

atCause Law Office

Dec 5, 20253 min read

Why Adding Someone to Your Business to Avoid Probate Can Backfire: A Real Estate Planning Story

During an estate planning consultation I ran into a situation I’ve seen many times over the years—one that I suspect happens far more often than people realize. Because so many families face the same dilemma, I wanted to break it down in a way that can help others who are weighing similar choices in their estate planning. Meet “Bob” and His Two Estate Planning Goals For privacy reasons, we’ll call today’s client “Bob.” Bob came in with two very common goals: Keep costs as low

Ashly Guernaccini

Dec 2, 20254 min read

Blog

bottom of page

.png)