top of page

Search

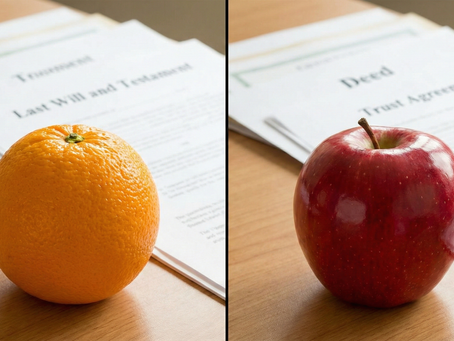

Transfer on Death Deed vs. Lady Bird Deed: What Is the Difference?

Are a Transfer on Death Deed and a Lady Bird Deed the same thing? The short answer is: No, they are not. If you live in a state like Florida, you might hear these terms used interchangeably. It is very common for people to conflate the two concepts, assuming they are identical tools for estate planning . While they share similarities in how they transfer property, there are critical legal and practical differences you need to know. Below, we break down exactly how these two

atCause Law Office

Jan 133 min read

Estate Planning Costs: Why Cheap Online Deeds Often Fail

If you are asking "What should be the price of an estate plan that includes two deeds?" , the answer depends heavily on the level of service and where you live. Online/DIY Forms: $50 – $150 (High risk of errors) Attorney-Drafted Deeds: $350 – $950 per deed (Plus recording fees) Basic Trust Plan (Low End): $2,500 – $3,000 Comprehensive Trust Plan (Couples/High Service): $5,000 – $7,000+ Note: Prices vary by state and county. The ranges above reflect typical costs for servi

atCause Law Office

Jan 63 min read

Do You Need a Lady Bird Deed if You Have a Trust?

If you are planning your estate, you might be asking a common question: "If I already have a trust, do I still need a Lady Bird Deed?" The short answer is: It’s not always one or the other. While both tools are designed to help your loved ones avoid the headaches of probate, attorneys often suggest utilizing the two of them together for maximum protection and efficiency. Quick Answer: The Strategy A Lady Bird Deed (available in Texas, Vermont, Michigan, West Virginia, and Fl

atCause Law Office

Dec 23, 20253 min read

Florida: Only One Spouse on the Deed But Both on the Mortgage – What Happens When Someone Dies? (2025 Guide)

Only One Spouse on the Deed But Both on the Mortgage in Florida – Here’s What Actually Happens I get this question every single week: “We bought the house before we got married. Both of us are on the mortgage, but only one name is on the deed. If something happens to my spouse, do I automatically get the house?” The short answer: No — you do NOT automatically get the house. In Florida, ownership is decided 100% by the deed. The mortgage means nothing when it comes to who leg

atCause Law Office

Nov 20, 20252 min read

Transfer on Death Deed vs. Trust: Which One Prevails for Your House?

In estate planning, it's common to wonder about conflicting instructions for your assets, especially real estate like your home. What if you initially set up a house as payable on death to one person, but later decide to place the same house into a trust for someone else? This scenario raises important questions about which designation rules. Let's break it down step by step based on how deeds work. Understanding Transfer on Death Deeds A transfer on death deed (often called

atCause Law Office

Nov 10, 20253 min read

2025 Update: Lady Bird Deed Florida – No Transfer Tax, Just Recording Costs

In the world of estate planning, Lady Bird deeds have become a popular tool for Florida homeowners looking to pass on their property smoothly without the headaches of probate. But a common question arises: When you change your deed to a Lady Bird deed , do you have to pay fees like documentary stamp taxes (doc stamps) or county recording fees? If you're in Florida and considering this option, you're in the right place. This guide breaks it down step by step, based on expert i

atCause Law Office

Nov 3, 20254 min read

Florida Estate Planning: Why a Trust Isn’t Always Best

In Florida estate planning, one common question stands out: Why not just put real property in a trust to avoid probate? While a revocable living trust is often the gold standard for transferring assets seamlessly, it isn’t always the most practical or cost-effective choice. Sometimes, adding heirs to a deed with rights of survivorship—or using a Lady bird deed —makes more sense depending on your financial situation, family dynamics, and long-term tax goals. This guide breaks

atCause Law Office

Oct 29, 20253 min read

Can Medicaid Take Your House After a Parent's Death? Insights on Joint Tenancy with Survivorship in Florida

If you're a joint tenant with rights of survivorship on a property with your parent, and they're receiving government benefits like SSDI or Medicaid, you might worry about what happens to the house after they pass away. A common question is: Can the government come after the house? In this post, we'll break down the key differences between SSI and SSDI, explain why Social Security typically isn't a concern for property liens, and dive into how Medicaid recovery works—especial

atCause Law Office

Oct 21, 20253 min read

Avoiding Capital Gains Tax with a Revocable Living Trust

Discover how a revocable living trust in Florida can help your beneficiary avoid capital gains tax with a step-up in basis and bypass probate. Learn the benefits today!

atCause Law Office

Sep 4, 20254 min read

Blog

bottom of page

.png)